what happens to price and quantity in the long run?

Chapter 8. Perfect Competition

8.three Entry and Go out Decisions in the Long Run

Learning Objectives

By the end of this section, you will exist able to:

- Explain how entry and exit lead to zip profits in the long run

- Discuss the long-run adjustment procedure

The line between the curt run and the long run cannot be defined precisely with a stopwatch, or fifty-fifty with a calendar. Information technology varies according to the specific business organisation. The distinction between the short run and the long run is therefore more technical: in the short run, firms cannot change the usage of fixed inputs, while in the long run, the firm can adjust all factors of production.

In a competitive market place, profits are a carmine cape that incites businesses to accuse. If a business is making a profit in the brusk run, it has an incentive to expand existing factories or to build new ones. New firms may start production, as well. When new firms enter the manufacture in response to increased industry profits it is called entry.

Losses are the black thundercloud that causes businesses to flee. If a business organisation is making losses in the short run, it will either keep limping along or but shut down, depending on whether its revenues are covering its variable costs. Merely in the long run, firms that are facing losses volition close downward at to the lowest degree some of their output, and some firms will finish product birthday. The long-run process of reducing production in response to a sustained design of losses is called get out. The following Clear It Up characteristic discusses where some of these losses might come from, and the reasons why some firms get out of business.

Why practice firms end to exist?

Can nosotros say anything about what causes a house to exit an manufacture? Profits are the measurement that determines whether a business stays operating or not. Individuals start businesses with the purpose of making profits. They invest their money, time, attempt, and many other resources to produce and sell something that they promise volition requite them something in return. Unfortunately, non all businesses are successful, and many new startups presently realize that their "business adventure" must eventually end.

In the model of perfectly competitive firms, those that consistently cannot make coin will "exit," which is a nice, bloodless word for a more painful procedure. When a business fails, after all, workers lose their jobs, investors lose their coin, and owners and managers can lose their dreams. Many businesses neglect. The U.S. Modest Business Administration indicates that in 2011, 409,040 new firms "entered," and 470,376 firms failed.

Sometimes a business fails because of poor management or workers who are non very productive, or because of tough domestic or foreign contest. Businesses also neglect from a diverseness of causes that might best be summarized every bit bad luck. For instance, atmospheric condition of need and supply in the market shift in an unexpected mode, so that the prices that tin can be charged for outputs fall or the prices that need to exist paid for inputs rise. With millions of businesses in the U.S. economy, fifty-fifty a pocket-sized fraction of them failing will affect many people—and business organization failures can be very difficult on the workers and managers directly involved. Only from the standpoint of the overall economy, business exits are sometimes a necessary evil if a market-oriented system is going to offering a flexible machinery for satisfying customers, keeping costs depression, and inventing new products.

How Entry and Go out Lead to Zero Profits in the Long Run

No perfectly competitive house acting alone can touch the market price. Nevertheless, the combination of many firms entering or exiting the marketplace will affect overall supply in the market. In turn, a shift in supply for the market place as a whole will affect the market price. Entry and go out to and from the market are the driving forces behind a procedure that, in the long run, pushes the price downward to minimum average total costs then that all firms are earning a naught profit.

To understand how curt-run profits for a perfectly competitive firm volition evaporate in the long run, imagine the post-obit state of affairs. The market is in long-run equilibrium, where all firms earn zero economic profits producing the output level where P = MR = MC and P = AC. No firm has the incentive to enter or go out the market. Permit's say that the production's need increases, and with that, the marketplace cost goes up. The existing firms in the industry are now facing a higher price than earlier, and then they volition increase production to the new output level where P = MR = MC.

This will temporarily make the market price rise above the average cost curve, and therefore, the existing firms in the marketplace will now be earning economical profits. However, these economical profits concenter other firms to enter the market. Entry of many new firms causes the marketplace supply bend to shift to the right. Every bit the supply curve shifts to the right, the market place price starts decreasing, and with that, economic profits fall for new and existing firms. As long as there are still profits in the market, entry will go along to shift supply to the right. This will stop whenever the market toll is driven downwardly to the zero-turn a profit level, where no firm is earning economic profits.

Short-run losses will fade away by reversing this process. Say that the marketplace is in long-run equilibrium. This time, instead, demand decreases, and with that, the market place price starts falling. The existing firms in the manufacture are now facing a lower price than before, and every bit it will be below the boilerplate cost curve, they volition at present exist making economic losses. Some firms volition continue producing where the new P = MR = MC, as long as they are able to embrace their average variable costs. Some firms volition take to shut down immediately as they will non be able to cover their average variable costs, and volition then only incur their stock-still costs, minimizing their losses. Exit of many firms causes the market supply bend to shift to the left. As the supply curve shifts to the left, the market price starts rising, and economic losses start to be lower. This process ends whenever the market price rises to the zero-turn a profit level, where the existing firms are no longer losing money and are at nix profits again. Thus, while a perfectly competitive firm can earn profits in the short run, in the long run the process of entry will push downwards prices until they reach the zero-turn a profit level. Conversely, while a perfectly competitive business firm may earn losses in the brusk run, firms will not continually lose money. In the long run, firms making losses are able to escape from their fixed costs, and their exit from the market place volition button the toll back up to the cypher-turn a profit level. In the long run, this process of entry and get out volition bulldoze the price in perfectly competitive markets to the zero-profit indicate at the bottom of the AC bend, where marginal cost crosses average cost.

The Long-Run Adjustment and Industry Types

Whenever in that location are expansions in an industry, costs of production for the existing and new firms could either stay the same, increase, or fifty-fifty subtract. Therefore, we can categorize an industry as being (one) a abiding toll manufacture (as need increases, the cost of production for firms stays the same), (2) an increasing cost manufacture (as need increases, the price of product for firms increases), or (3) a decreasing cost industry (as demand increases the costs of product for the firms decreases).

For a abiding cost industry, whenever in that location is an increment in marketplace demand and price, then the supply curve shifts to the right with new firms' entry and stops at the point where the new long-run equilibrium intersects at the aforementioned market place price as earlier. But why will costs remain the same? In this type of industry, the supply bend is very elastic. Firms tin can hands supply any quantity that consumers demand. In addition, there is a perfectly elastic supply of inputs—firms tin easily increase their demand for employees, for example, with no increase to wages. Tying in to our Bring it Home discussion, an increased demand for ethanol in contempo years has caused the demand for corn to increase. Consequently, many farmers switched from growing wheat to growing corn. Agricultural markets are generally good examples of constant price industries.

For an increasing cost industry, every bit the market expands, the old and new firms experience increases in their costs of production, which makes the new zero-profit level intersect at a higher price than before. Here companies may accept to deal with limited inputs, such as skilled labor. Every bit the demand for these workers rise, wages rise and this increases the price of production for all firms. The manufacture supply bend in this type of industry is more inelastic.

For a decreasing price industry, as the marketplace expands, the old and new firms feel lower costs of production, which makes the new zero-profit level intersect at a lower price than before. In this case, the industry and all the firms in information technology are experiencing falling boilerplate full costs. This tin be due to an improvement in technology in the unabridged industry or an increase in the education of employees. Loftier tech industries may be a practiced case of a decreasing cost market place.

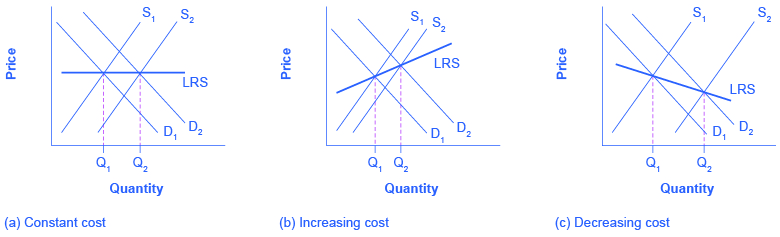

Figure 1 (a) presents the case of an aligning process in a constant cost manufacture. Whenever there are output expansions in this type of industry, the long-run outcome implies more output produced at exactly the same original toll. Note that supply was able to increase to meet the increased demand. When we join the before and afterwards long-run equilibriums, the resulting line is the long run supply (LRS) curve in perfectly competitive markets. In this case, it is a flat curve. Effigy one (b) and Figure 1 (c) nowadays the cases for an increasing cost and decreasing toll manufacture, respectively. For an increasing cost industry, the LRS is up sloping, while for a decreasing cost industry, the LRS is downwards sloping.

Fundamental Concepts and Summary

In the long run, firms will respond to profits through a procedure of entry, where existing firms expand output and new firms enter the market. Conversely, firms will react to losses in the long run through a process of get out, in which existing firms reduce output or cease production altogether. Through the procedure of entry in response to profits and exit in response to losses, the price level in a perfectly competitive market place will motion toward the null-profit point, where the marginal cost curve crosses the Ac curve, at the minimum of the average toll bend.

The long-run supply curve shows the long-run output supplied by firms in iii dissimilar types of industries: constant cost, increasing cost, and decreasing price.

Self-Check Questions

- If new engineering science in a perfectly competitive market brings about a substantial reduction in costs of production, how will this bear upon the market?

- A market place in perfect competition is in long-run equilibrium. What happens to the market if labor unions are able to increase wages for workers?

Review Questions

- Why does entry occur?

- Why does leave occur?

- Do entry and get out occur in the short run, the long run, both, or neither?

- What toll volition a perfectly competitive firm end upward charging in the long run? Why?

Critical Thinking Questions

- Many firms in the United States file for bankruptcy every yr, yet they nonetheless continue operating. Why would they do this instead of completely shutting downwards?

- Why will profits for firms in a perfectly competitive industry tend to vanish in the long run?

- Why will losses for firms in a perfectly competitive industry tend to vanish in the long run?

Glossary

- entry

- the long-run process of firms entering an industry in response to manufacture profits

- leave

- the long-run process of firms reducing production and shutting downwardly in response to industry losses

- long-run equilibrium

- where all firms earn zero economic profits producing the output level where P = MR = MC and P = Air-conditioning

Solutions

Answers to Cocky-Cheque Questions

- With a technological improvement that brings about a reduction in costs of production, an aligning process volition take place in the market. The technological comeback will effect in an increase in supply curves, past individual firms and at the market level. The existing firms will experience higher profits for a while, which will attract other firms into the market place. This entry process will stop whenever the market supply increases enough (both by existing and new firms) and so profits are driven back to zero.

- When wages increase, costs of production increment. Some firms would now be making economic losses and would shut down. The supply bend and so starts shifting to the left, pushing the marketplace toll up. This procedure ends when all firms remaining in the market earn zero economical profits. The effect is a wrinkle in the output produced in the marketplace.

Source: https://opentextbc.ca/principlesofeconomics/chapter/8-3-entry-and-exit-decisions-in-the-long-run/

0 Response to "what happens to price and quantity in the long run?"

Post a Comment